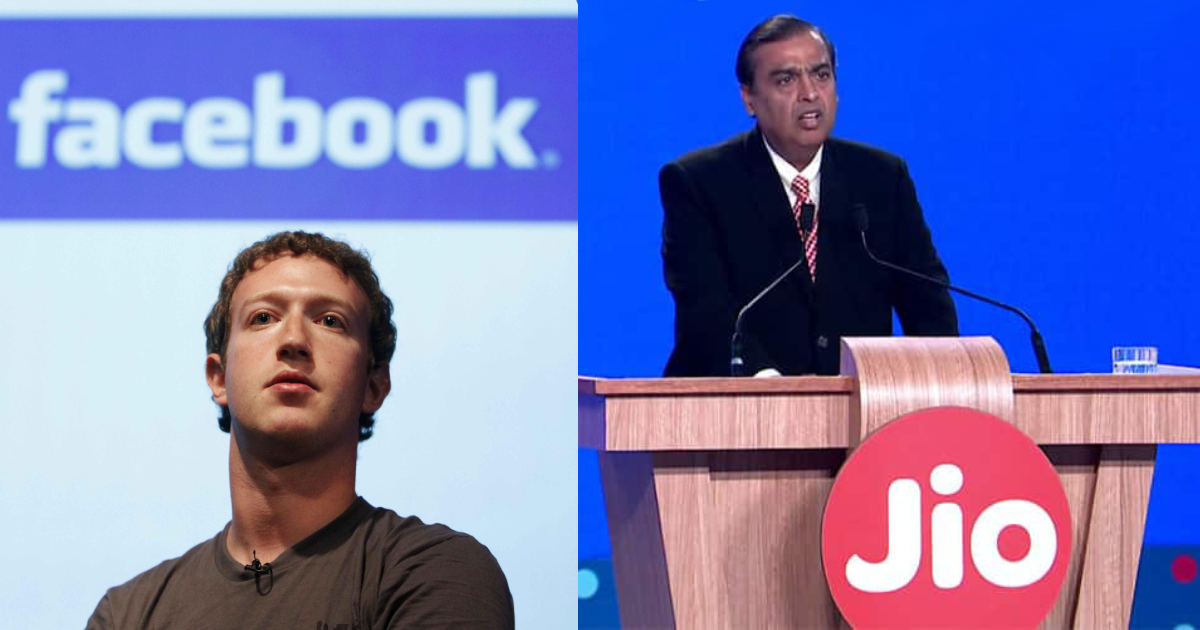

Facebook has its biggest user base in India where all its platforms – Facebook, Messenger, WhatsApp are household names. However, the rocketing popularity of TikTok app is being perceived as an emerging threat for the industry leader. Facebook is trying to tilt the balance in its favor and has acquired 9.99-percent in Reliance Jio.

As a part of the deal, Facebook will pick up a minority stake (9.99%) in the Reliance Industries digital business arm for Rs. 43,574 crores.

ALSO READ: Apple iPhone 12 Pro Leaks and Rumors roundup

What’s in it for Facebook in Jio deal?

Well as a part of the arrangement, the social media firm looks to leverage its WhatsApp chat service to offer digital payment services for Reliance Retail and JioMart.

While the Reliance Retail is currently India’s largest retail chain network, JioMart is an online grocery delivery platform that will partner with independent small Kirana stores and local vendors.

Under this new arrangement, WhatApp will become the medium for JioMart’s registered small Kirana stores and local vendors to place orders and payments.

With this integration, WhatsApp will become a super app similar to WeChat in China that will work for messaging, calls, shopping, and gaming. It will also become easy for businesses to connect with users directly.

AlSO READ: Samsung Galaxy Watch Active 2 To Get Blood Pressure Monitoring Feature in Q3, 2020

Why the Facebook-Jio deal is important for Reliance?

The debt of Reliance Industries, the parent company of Jio telecom, has been piling up ever-since it launched the Jio Telecom business. The current debt is estimated to be more than $40 billion or approx 3lakh crores. Selling minority stakes in Jio business will help Reliance Industries to substantially cut down its debt.

Last year, Billionaire Mukesh Ambani, chairman of Reliance Industries, announced their plans to become a debt-free company by 2021. At that time, it was announced that Reliance Industries will be selling a 20-percent stake in its oil and chemical refining business to Saudi’s Aramco for approx $15 billion (roughly Rs. 1.15 lakh crores), and approx $3 billion (roughly Rs. 23,000 crores) worth of stake in its telecom tower assets to Canadian Brookfield Asset Management private equity fund.

While the status of Saudi Aramco and Canadian Brookfield deals are unknown, parting with the less than 10-percent stake sale in Jio will help Reliance industries cut down its debt and to scale up its telecom operations.